United States. Sales of the specialty equipment market for the automotive industry grew to $52.3 billion in 2023, an increase of about 1% over 2022, according to the recently released "SEMA Market Report 2024."

The report, produced by SEMA Market Research, is the association's largest so far this year and offers new insights into the size and scope of the specialty equipment industry. The report includes detailed sizing of the market by parts category, consumer spending data by vehicle segment, and insights into where consumers purchased aftermarket parts and accessories in 2023, along with other key industry trends.

"The economy continues to offer some uncertainty, as we have emerged from the effects of COVID-19 and grappled with politics, global conflicts, and international trade policies," said SEMA director of market research Gavin Knapp. "However, consumers are still spending, and that will always be good for our industry. Unless there is a major economic shock, we can expect to continue at a reasonable growth rate going forward."

The report concludes that the light truck sector continues to drive the specialty equipment industry, with pickup trucks (32%), CUVs (15%), and SUVs (12%) accounting for more than half of sales of accessories and high-performance parts.

"Light trucks are a diverse and growing group of vehicles that have overtaken cars and now account for the majority of vehicles on the road in the United States," Knapp added. "They present a significant opportunity for the specialty equipment industry due to their versatile platforms for accessory incorporation, and this trend appears to be growing as more companies recognize the potential in this space."

Drivers are also equipping their vehicles with alternative energy, such as electric and hybrid vehicles, which generated $2.5 billion in sales in 2023. While EV sales have increased year-over-year, consumers are not flocking to this technology as some had predicted and many automakers are adjusting their transition plans. SEMA has lowered its forecast for electric vehicle sales, with internal combustion engine (ICE) vehicles expected to account for the majority of sales over the next decade.

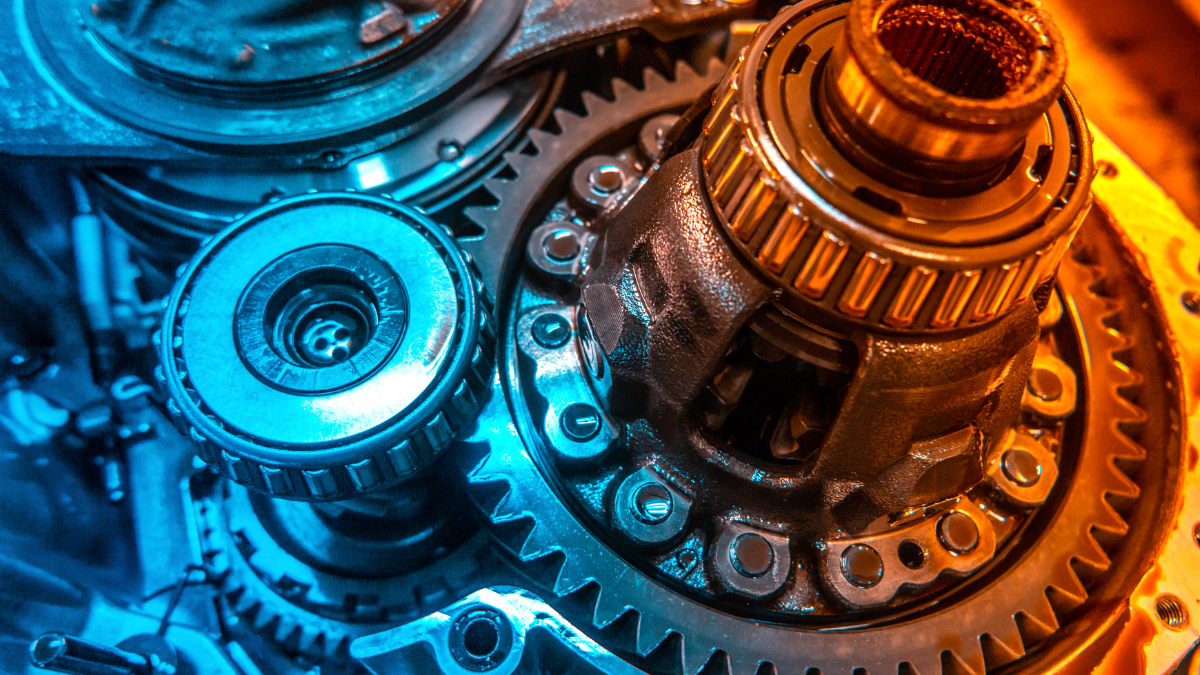

Even with the current economic uncertainty, sales in all market sectors continue to grow. Notably, sales of appearance products and accessories ($27 billion), engine and performance products ($12 billion), and wheels, tires, and handling ($12 billion) increased in 2023.

Other findings from the report include:

- Most of those who use accessories modify their vehicles for daily use; 58% of vehicles with accessories are used to commute to work.

- Young people continue to drive the market: half of accessory users are under 40 years old.

- Younger accessory users also tend to make more extensive modifications, such as suspension and engine performance modifications.

- More than half of accessory users (58%) also own a powersports product, such as a trailer, UTV or motorcycle, which can offer cross-selling opportunities and promotions.

- New vehicle sales are expected to exceed $16 billion by 2024.

- The U.S. vehicle fleet is made up of nearly 290 million passenger cars on the road. More cars on the road mean more opportunities for drivers to customize their vehicles.

In addition, more than 90% of the specialty equipment companies surveyed expect their 2024 sales to be equal to or higher than 2023. This is positive news as the industry prepares for the SEMA Show later this year, where more than 2400 brands will showcase and reveal their products and services to thousands of qualified buyers.