United States. The global aftermarket for electric and hybrid vehicles (xEVs) reached a value of $59 billion in 2024 and is projected to grow to $195 billion by 2035, with a compound annual growth rate (CAGR) of 11.5%, according to a new report from analytics firm MarketsandMarkets.

The study highlights that this growth will be driven by the sustained increase in the number of xEVs on the road, the ageing and higher mileage of these vehicles, the use of telematics to offer personalised services and the digitalisation of the value chain to improve the customer experience.

Transformation of the aftermarket

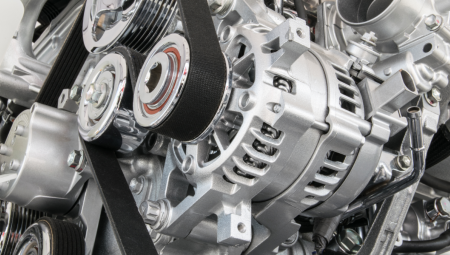

With the transition from internal combustion engines to electric powertrains, the aftermarket sector will undergo a transformation marked by the principles of the "4Rs": repair, reuse, recycle and remanufacture. In addition, a greater adoption of mobile services for the maintenance and diagnosis of electric vehicles is anticipated, as well as the boom in the conversion of old cars to electric systems, a trend that combines sustainability and customization.

The report also underlines the central role that data will play in the business models of the future. Predictive maintenance, based on real-time vehicle information, will enable proactive interventions, more efficient diagnostics and a personalized user experience. New opportunities will also open up from this data, facilitating a circular economy for EV components.

One of the pillars of the new aftermarket model will be the focus on batteries. The development of services focused on predictive monitoring of battery health and proactive maintenance is envisaged. These practices will extend their service life, optimize performance, and reduce failures, supported by efficient diagnostics and informed decisions about replacements or reuse in a "second life."

Leading companies in this market include Advance Auto Parts, Autozone, Carquest, LKQ Corporation, NAPA (all in the US), and GSF Car Parts (UK).

The report also provides a detailed analysis of original equipment manufacturer (OEM) aftermarket strategies, comparison with independent vendors (IAM), and the development of emerging services such as battery recycling, remote maintenance, sustainability integration, and mobile service units.