United States. President Trump's executive orders could transform the secondary truck market with new tariffs, regulatory changes and revisions to the USMCA trade agreement, creating uncertainty in costs and supply.

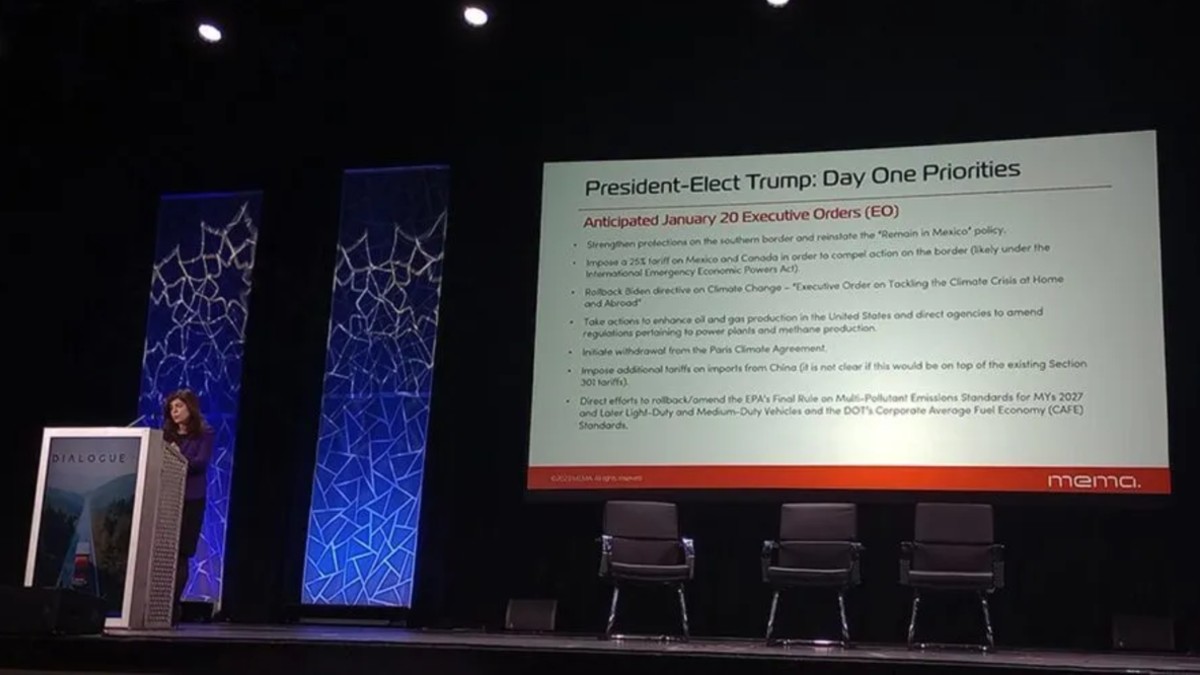

President Donald Trump's recent executive orders are creating uncertainty in the secondary trucking market, with potential new tariffs, regulatory freezes, and strategic changes in trade with Mexico and Canada. Ana Meuwissen, senior vice president of government affairs at MEMA, warned of the implications for the industry during her presentation at the Heavy Duty Aftermarket Dialogue event.

The specter of a 25% tariff on imports from Mexico and Canada threatens to destabilize the costs of spare parts. "While the power to impose tariffs rests with Congress, Congress has transferred much of that authority to the president," Meuwissen explained. Sections 301 and 232 have already raised raw material costs, and a new round of tariffs could send prices even higher, directly impacting dealers and truck fleets.

For now, the administration appears to be prioritizing investigations into trade deficits before implementing new tariffs, but tensions remain. According to Meuwissen, a recent executive memorandum directs federal agencies to address unfair trade practices, which could mean a tightening of measures in the near future.

Regulations on the tightrope: possible revisions to the environmental framework

Trump is also seeking to freeze ongoing regulations, such as NOx and greenhouse gas (GHG) emissions standards for heavy-duty trucks. These rules, set for 2027, could be delayed or modified, impacting fleets and suppliers that had already begun preparing to comply with the standards.

California could face a bigger hit. The administration has signaled its intention to withdraw key exemptions granted to the state for its clean fleet rules, challenging the authority of the California Air Resources Board (CARB). "Changing these regulations will not be quick or easy," said Meuwissen, who anticipates protracted litigation similar to those faced during Trump's first term.

On the tax front, the administration is considering extending and reducing the corporate rate under the Tax Cuts Act of 2017, which could benefit companies in the sector. However, the removal of incentives for electrification and alternative fuels, funded by repealing key programs from the Inflation Reduction Act, worries suppliers.

"MEMA is closely monitoring how these reforms could impact those who have already invested in sustainability and regulatory compliance," Meuwissen noted.

The U.S.-Mexico-Canada trade agreement (USMCA) is set to be reviewed in 2026, and the current administration seems inclined to renegotiate stricter regional content requirements. This could complicate logistics for suppliers operating in cross-border chains and increase production costs.

As policies evolve, the industry faces a landscape of challenges and opportunities. Reversing regulations could offer temporary relief in compliance costs, but also slow the transition to cleaner technologies. On the other hand, trade and fiscal tensions could raise operating costs and put pressure on the availability of parts in the market.

MEMA, according to Meuwissen, is already working with policymakers to ensure the needs of the sector are heard, but fleets and suppliers must prepare to navigate this changing environment with adaptive strategies.